Greetings from our quarterly offsite in NYC where we spent our time discussing strategy (and the art of crafting cavatelli). And while we ultimately decided our next steps should not go in the direction of “steal Scarlett Johansson’s voice,” the day was a great excuse to cook a lot of great food, drink a lot, and pat ourselves on the back for not being the people who got the Dublin portal shut down (despite being so very close to it).

But enough about us and onto the #content that you’ve been craving…

How to Make Money Marketing Interesting

Part of the company ethos here at LHC is that we love money. We love to have it, to spend it, to squirrel it away, and, occasionally, just look at it. And we’d like more of it (and yes, we do accept Venmo, CashApp, and sure, for you trad types out there, client contracts). But despite the fact that almost everyone agrees money is unambiguously useful, financial marketing tends to be less so.

In short, the majority of companies selling financial services and tools can’t seem to figure out how to talk about themselves without making us ask, “But what do you actually do?”

Sure, maybe your business is the best in the world at empowering consumers and SMEs with the ability to disintermediate digital payment platforms through the seamless execution of distributed ledger technology, but huh?

Why is this lack of clarity so prevalent in finance? Let’s break it down.

For starters, finance is complex. Sure, there are the Venmos of the world that are easy to comprehend (even if you don’t quite understand why their feed brings out your most voyeuristic tendencies).

But there are also companies that manage complex financial instruments, handle payment processing, or offer cash flow analytics. On the surface you probably get what they do – maybe you can even explain it clearly to someone else. But can you explain it in a 90-character email subject line that makes someone say “Holy shit, cancel my afternoon, I gotta click that!”?

Second, there’s the issue of targeting the right audience, which for finance can be B2B, B2B2C and everywhere in-between. In an ideal world, a marketing team would be able to effectively deploy as many different strategies as there are audience segments. In the actual, “everyone wears all the hats” world we live in, it usually means marketers are stuck trying to create one strategy that reaches everyone.

And then there’s the biggie: a successful financial marketing campaign requires your audience to trust you. And if they’re going to trust you, they need to know you. But how can a business build true brand awareness campaigns, when all too often marketers are measured by their ability to drive lead gen?

So, how do you build effective campaigns that don’t fall into these traps?

Venmo us and we’ll send you our 10 Secrets to Marketing Success white paper.

Or, fine, just keep reading.

Let’s start with building trust. That requires an investment in brand building. And not just brand awareness, but a messaging strategy that simultaneously introduces your business and focuses on why people should trust you. SoFi, for example, has done a great job of both brand messaging, meeting prospects where they are, and speaking to them like fellow humans.

Once you have that brand messaging down, you’re going to need to get clear about what you do. Forget about trying to appeal to everyone. Go after your audience in the language they’ll understand. If someone doesn’t get it from an ad, or your homepage, they’re not going to sign up for your webinar.

Part of doing this effectively is naming the problem you’re solving in clear language. You don’t need to be transformative or innovative or AI-powered. You just need to be make someone’s life (and/or job) easier.

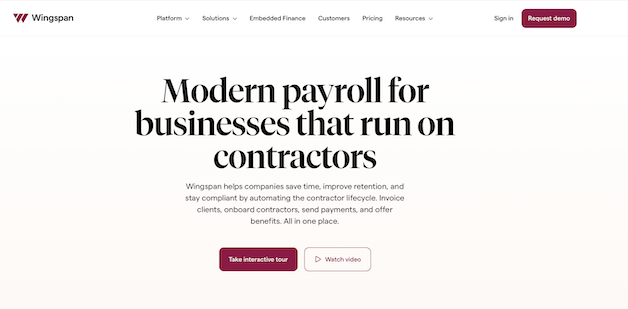

Take Wingspan for example. Their homepage cuts to the chase and tells us what problem they solve and how. Done. I’ll take 10.

Then, you need to invest in a true marketing mix (yes, like any industry). You obviously need a strong B2B funnel and you need brand awareness campaigns for company decision makers. But you also need a consumer-facing strategy if your product is B2B2C.

For example, do you trust an establishment that uses Square? Probably!

But if a barista turned that iPad screen to you and it said “Your payment will be processed using the girthmaster,” would you be more or less likely to give them your credit card info?

Yes, that’s a Scrooge McDuck tattoo sported by one of our co-founders

Want to start improving your business’s financial marketing strategy without Venmoing us first? Then just get in touch!